Many businesses scale through real estate acquisition and renovation, and commercial loans help them achieve their real estate goals.

Here at RealAtom, we pride ourselves on matching our clients with the optimal loan for their business.

Lenders routinely work with a wide pool of business clients to help match them with financing for their projects, and many small businesses have unique opportunities to borrow from SBA-affiliated lenders to fund their real estate purchases.

Although you may think that big businesses drive the demand for commercial loans, today, we are going to discuss how small businesses can get their slice of the pie through different loan structures.

Commercial Real Estate Loans Come for Small Businesses

Over 99% of businesses in America are considered small businesses.

These firms can range in size from sole proprietorships to more than a thousand employees. Regardless of their size, at some point, they may need access to financing for a commercial real estate loan.

Commercial loans to small businesses can range from $350,000 to over $5 million, depending on need and creditworthiness.

Small businesses can use the funds to either purchase new properties, renovate a building they currently own, or build a brand new construction.

Small Businesses Can Purchase Real Estate Through Commercial Loans

Loan terms for small businesses are similar to their jumbo loan counterparts and stipulate that the business should occupy at least 51% of the real estate and either pay fully amortized loans or interest-only payments with a large balloon payment at the end of the term.

Let’s look at some of the most common forms of commercial real estate loans for small businesses:

Commercial Bridge Loans

Bridge loans provide short to medium-term financing for businesses that are trying to secure longer-term loans. These loans help business owners at the initial stage of a real estate project because they generally require lower down payments which range from 10%-20%, whereas most larger mortgages can easily require up to 35% down.

Since these bridge loans are a short-term solution, they can range anywhere from six months to two years at a maximum.

SBA 7(a) Loan

This is the primary loan provided by the Small Business Association. Funds for the SBA 7(a) can be used for most commercial real estate purchases and can reach up to $5 million.

SBA affiliate lenders will issue these loans, and the maximum interest rate is capped at the WSJ prime rate plus a few basis points as margin. Terms are flexible and can be variable, fixed, or some combination of both.

These are fully amortized loans, so the monthly payment will be the same until the loan is paid off.

SBA 504 Loan

SBA 504 loans add some more flexibility for owner-occupied businesses, but they combine a regular SBA loan with another loan offered by a Certified Development Company (CDC), which can add an additional 40% to your original loan balance.

This brings your total borrowing potential up to $10 million, and if you are considering an SBA 504 Loan, you should aim to borrow at least $350,000.

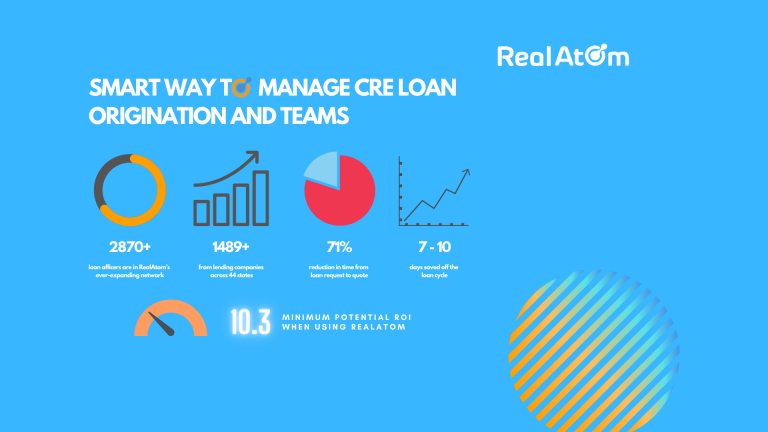

The Only Complete Digital Lending Solution

Whether you are a small business in need of bridge financing or a large lender trying to close a $100mm deal, RealAtom is the only completely integrated commercial real estate solution used by thousands of Commercial and Small Business Lenders, borrowers, brokers to secure loans fast.